BTC Price Prediction: Path to $200,000 Strengthened by Technical Breakout and Institutional Demand

#BTC

- Technical Breakout Configuration - Price trading above key moving average with Bollinger Band expansion suggesting momentum building

- Institutional Capital Inflow - Over $2 billion in recent institutional acquisitions creating substantial buying pressure

- Macro Policy Support - Fed rate cuts historically bullish for risk assets, though current impact is measured

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

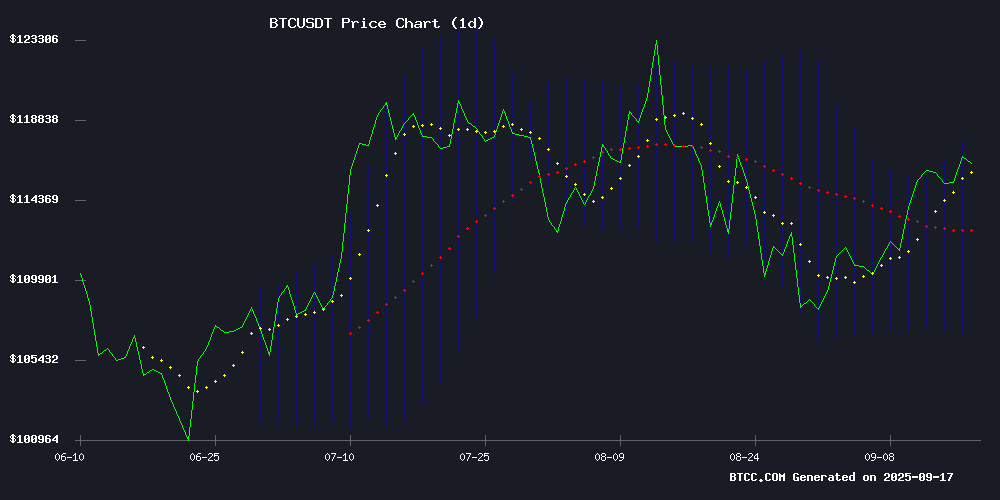

BTC is currently trading at $116,200, positioned comfortably above its 20-day moving average of $112,447. This technical positioning suggests underlying strength in the market. The MACD indicator, while still negative at -2551.39, shows improving momentum with the histogram reading of -1722.68. The price trading NEAR the upper Bollinger Band at $118,092 indicates potential for continued upward movement, though traders should watch for potential resistance at this level.

According to BTCC financial analyst Emma, 'The technical setup suggests BTC has established a solid foundation above key support levels. The combination of price above the moving average and approaching the upper Bollinger Band typically indicates bullish momentum, though we may see some consolidation before the next major move.'

Market Sentiment: Institutional Adoption Offsets Fed Impact

The news landscape reveals a complex interplay between institutional adoption and macroeconomic factors. Major developments include GD Culture's $875 million Bitcoin acquisition positioning it as a top public holder and Metaplanet raising $1.4 billion to enter the U.S. market. These institutional moves are creating strong underlying support for Bitcoin despite the Fed's rate cut having limited immediate impact.

BTCC financial analyst Emma notes, 'While the Fed's 25 basis point rate cut generated only a 1% immediate price increase, the fundamental story remains incredibly strong. The reactivation of dormant wallets moving 1,000 BTC after years of inactivity, combined with massive institutional acquisitions, suggests we're seeing early stages of a major capital rotation into digital assets.'

Factors Influencing BTC's Price

Dormant Bitcoin Wallets Reactivate, Moving 1,000 BTC After Years of Inactivity

Blockchain data reveals a surge in activity from long-dormant Bitcoin wallets, with one address executing its first transaction in over a decade. A total of 1,000 BTC has been moved, sparking speculation about the motives behind these sudden transfers.

Market observers note the timing coincides with Bitcoin's volatile price action and shifting regulatory landscapes. While some interpret the movements as profit-taking by long-term holders, others suggest security upgrades or personal circumstances may be driving the activity.

The reactivation of cold wallets containing substantial BTC reserves often signals strategic portfolio adjustments during periods of market uncertainty. These movements typically attract heightened attention from both crypto analysts and traditional financial institutions monitoring blockchain liquidity events.

Bitcoin Shows Resilience as Fed Rate Cut Fails to Stir Crypto Markets

Bitcoin demonstrated unexpected stability following the Federal Reserve's anticipated 25 basis point rate cut, slipping just 0.69% after briefly touching $117,000. The cryptocurrency's muted reaction suggests markets had already priced in the Fed's move—a classic case of 'buy the rumor, sell the news' behavior.

The broader crypto market capitalization held steady above $4 trillion, with top-20 cryptocurrencies averaging a mere 0.43% decline. This tepid response challenges conventional wisdom that rate cuts automatically boost risk assets, indicating traders may be experiencing Fed policy fatigue.

Market sentiment remains neutral despite the dovish pivot, with some predictors leaning bullish. The lack of volatility underscores crypto's growing maturity as an asset class, though the failure to sustain gains above $117,000 reveals persistent psychological resistance levels.

GD Culture’s $875M Bitcoin Acquisition Positions It as Top Public Holder

Nasdaq-listed GD Culture Group has made a bold entry into cryptocurrency, acquiring 7,500 Bitcoin (BTC) worth $875.4 million from Pallas Capital in exchange for 39.2 million shares. This strategic move elevates the company to the 14th largest public BTC holder globally.

CEO Xiaojian Wang frames the acquisition as a cornerstone for building a diversified crypto asset reserve, capitalizing on Bitcoin's growing recognition as an institutional-grade store of value. The deal follows GD Culture's May announcement of plans to allocate up to $300 million in stock for crypto treasury development.

The transaction reflects accelerating corporate adoption of Bitcoin as a balance sheet asset, with publicly traded companies increasingly viewing cryptocurrency as a hedge against inflation and dollar debasement.

Japanese Bitcoin Giant Metaplanet Raises $1.4 Billion to Enter U.S. Market

Metaplanet, once a struggling hotel operator, has pivoted to become one of the world's top Bitcoin treasury firms, now holding over 20,000 BTC worth $2.3 billion. The company ranks as the sixth-largest corporate Bitcoin holder globally.

Its U.S. expansion includes the establishment of Metaplanet Income Corp. in Miami, focusing on Bitcoin derivatives trading and income generation. The derivatives business, launched in late 2024, has already proven profitable and is described by CEO Simon Gerovich as the company's "engine of growth."

Miami's emergence as a Bitcoin hub and Florida's business-friendly policies made it an ideal location for Metaplanet's operations. The company raised $1.44 billion through an international share offering, exceeding its initial target due to strong investor demand.

Crypto Market Dips Slightly Following Fed's Expected 25 Bps Rate Cut

The cryptocurrency market experienced a modest decline following the Federal Reserve's anticipated 25 basis point rate cut, with the total market capitalization dropping 1% to approximately $4.1 trillion. Bitcoin briefly touched $114,940 before recovering slightly to $115,698.

Market analysts attribute the dip to profit-taking behavior as traders executed 'sell-the-news' strategies following the widely predicted policy move. The Fed's decision to maintain quantitative tightening measures while cutting rates created mixed signals for risk assets.

Central bank officials signaled potential additional rate reductions totaling 50 basis points before year-end, though continued balance sheet contraction through bond sales may temper market enthusiasm. The crypto sector's reaction highlights its evolving sensitivity to traditional monetary policy developments.

Fed Rate Cuts Spark Bullish Sentiment for Bitcoin and Altcoins

The Federal Reserve's anticipated 25-basis-point rate cut has shifted market focus to the central bank's dovish tone, with implications for cryptocurrency markets. Fed Chair Jerome Powell's emphasis on employment risks and openness to further easing signals a potential tailwind for digital assets.

Analysts project Bitcoin could rally toward $120,000-$125,000 if the Fed maintains its accommodative stance. Shawn Young of MEXC notes that while the cut was priced in, elevated inflation keeps markets attuned to future policy direction. The dissent calling for a 50-basis-point reduction underscores growing dovish pressures.

Altcoins face mixed prospects—blue-chip cryptocurrencies may benefit from risk-on flows, but uncertainty about additional easing tempers broader optimism. The market now watches whether this marks the beginning of a sustained dovish pivot or a measured adjustment.

Bitcoin Eyes $210K as Fed Rate Cut Echoes 80% Rally History

Bitcoin's price trajectory is drawing comparisons to its 2024 surge following a Federal Reserve rate cut, with analysts speculating a repeat performance could propel BTC toward $210,000. The cryptocurrency currently trades near $116,325 as of September 17, 2025, fueling debates about its potential to mirror the 80% rally observed post-rate cut last year.

Institutional momentum adds weight to the bullish case. A single wallet's $680 million BTC purchase on September 16 underscores growing confidence among deep-pocketed investors. Historical data from the Kobeissi Letter reveals risk assets typically gain 14% within a year of rate cuts—a pattern Bitcoin has loosely followed during past monetary easing cycles.

GD Culture Stock Plummets 28% Following $875M Bitcoin Share Deal

Shares of Nasdaq-listed GD Culture Group (GDC) plunged more than 28% this week after the company announced a controversial acquisition of 7,500 Bitcoin via a stock-swap deal with Pallas Capital. The $875 million transaction, while ambitious, has sparked concerns about shareholder dilution and the viability of corporate Bitcoin strategies.

The deal positions GD Culture as the 14th-largest corporate holder of Bitcoin globally, alongside industry giants like MicroStrategy and Tesla. CEO Xiaojian Wang framed the move as a strategic pivot toward cryptocurrency, citing Bitcoin's store-of-value proposition and institutional adoption. Market reaction was swift and brutal—investors dumped shares amid skepticism about the dilution of nearly 39.2 million new shares issued to fund the acquisition.

Bitcoin Volatility Surges Following Fed Rate Cut Decision

Bitcoin experienced sharp price swings as the Federal Reserve implemented a widely anticipated 25 basis-point rate cut, lowering the target range to 4%-4.25%. The cryptocurrency briefly rallied to $116,318 before plunging to $114,820 in a classic 'sell-the-news' reaction, ultimately stabilizing near $115,600.

The Fed's first policy adjustment in months triggered immediate volatility across digital assets, underscoring their sensitivity to dollar liquidity conditions. While markets had priced in the move, the speed of Bitcoin's reaction revealed how traders are positioning for shifting monetary policy landscapes.

All eyes now turn to Chair Powell's press conference for signals about potential additional easing before year-end. The central bank simultaneously announced operational changes including $500 billion in overnight repo capacity, further reshaping the liquidity environment that crypto markets increasingly track.

Fed Cuts Rates for First Time Since 2022, Bitcoin Rises 1%

The Federal Reserve delivered its first interest rate cut in ten months, lowering the benchmark rate by 25 basis points to 4%-4.25%. The move comes amid signs of moderating economic growth and a weakening labor market, with August's jobs report showing only 22,000 positions added.

Bitcoin (BTC) immediately gained 1% following the announcement, while U.S. equities extended their record-breaking rally. Market participants now await Fed Chair Jerome Powell's press conference for clues about future policy direction.

The decision follows mounting political pressure and economic crosscurrents. Recent data revisions revealed substantially weaker job creation than previously reported, while inflation metrics remain contested. Cryptocurrencies appear positioned as beneficiaries of renewed monetary accommodation.

China's Yuan Internationalization Gains Momentum as Bitcoin Emerges as Potential Reserve Asset

China's strategic shift away from dollar dominance is accelerating, with half of all international payments now conducted in yuan. The currency's cross-border payment system reports 40% annual growth, signaling a structural change in global finance.

BRICS nations champion this 'multipolar' financial system, with Bitcoin and gold waiting in the wings as potential reserve assets. Central bank governor Pan Gongsheng's June remarks about dollar competition now appear prescient as yuan usage spans trade, services, and Silk Road investments.

The dollar's hegemony faces its most credible challenge in decades. While yuan adoption grows through institutional channels, decentralized alternatives like Bitcoin are positioning as neutral reserve assets in this new financial order.

Will BTC Price Hit 200000?

Based on current technical indicators and market developments, the path to $200,000 appears increasingly plausible though not immediate. The combination of strong technical positioning above key moving averages, massive institutional acquisitions, and renewed whale activity creates a fundamentally bullish backdrop.

| Factor | Current Status | Impact on $200K Target |

|---|---|---|

| Price vs 20-day MA | $116,200 vs $112,447 | Bullish - 3.3% above support |

| Bollinger Band Position | Near upper band ($118,092) | Neutral - potential resistance |

| Institutional Acquisition | $875M + $1.4B recent moves | Very Bullish - massive demand |

| Fed Policy Impact | Limited immediate effect | Neutral - long-term supportive |

| Whale Activity | 1,000 BTC moved from dormancy | Bullish - renewed interest |

BTCC financial analyst Emma suggests: 'While $200,000 represents a 72% increase from current levels, the convergence of technical strength and institutional adoption provides a realistic foundation for this target, likely achievable within the next 12-18 months if current momentum sustains.'